Japan's Zero-Tariff Policy: Impact on US Car Exports in 2025

The international automotive trade landscape has undergone significant changes in early 2025, particularly in the relationship between the United States and Japan. While much attention has focused on the recent 25% tariff on imported vehicles entering the US, Japan's longstanding zero-tariff policy on passenger vehicles presents an interesting counterpoint in this evolving trade dynamic. This article examines Japan's approach to auto imports, its impact on US exports, and the implications for international vehicle shipping in 2025.

Understanding Japan's Zero-Tariff Policy

Contrary to common misconceptions, Japan maintains a 0% tariff rate on imported passenger vehicles. This policy has been in place for decades, theoretically creating an open market for foreign automakers, including those from the United States. However, despite this apparent market access, American-made vehicles have struggled to gain significant market share in Japan.

Key aspects of Japan's auto import policy include:

-

Zero Import Duty: Japan imposes no tariffs on imported passenger cars

-

Non-Tariff Barriers: Regulatory requirements, safety standards, and certification processes that differ from US specifications

-

Consumer Preferences: Strong domestic brand loyalty and specific requirements for Japan's driving conditions and urban environments

This zero-tariff policy stands in stark contrast to the US approach, which historically maintained a 2.5% tariff on imported passenger vehicles before the dramatic increase to 25% in April 2025.

US Car Exports to Japan: Current State and Challenges

Despite Japan's zero-tariff policy, US automakers have achieved limited success in the Japanese market. In 2024, American-made vehicles accounted for less than 2% of Japan's auto market, with European luxury brands capturing a larger share of imported vehicle sales.

Several factors contribute to this trade imbalance:

Market Fit Challenges

-

Vehicle Size: Many American vehicles are designed for US roads and parking spaces, making them impractical for Japan's compact urban environments

-

Right-Hand Drive: Japan's right-hand drive requirement necessitates special production runs that many US manufacturers find economically unfeasible

-

Fuel Efficiency Standards: Japanese consumers strongly prefer high-efficiency vehicles due to high fuel costs and environmental regulations

Distribution and Service Networks

-

Limited dealer networks for American brands

-

Concerns about parts availability and service support

-

Higher maintenance costs for US vehicles compared to domestic options

Cultural Preferences

-

Strong brand loyalty to domestic manufacturers

-

Perception of Japanese vehicles as higher quality and more reliable

-

Limited marketing investment by US automakers in the Japanese market

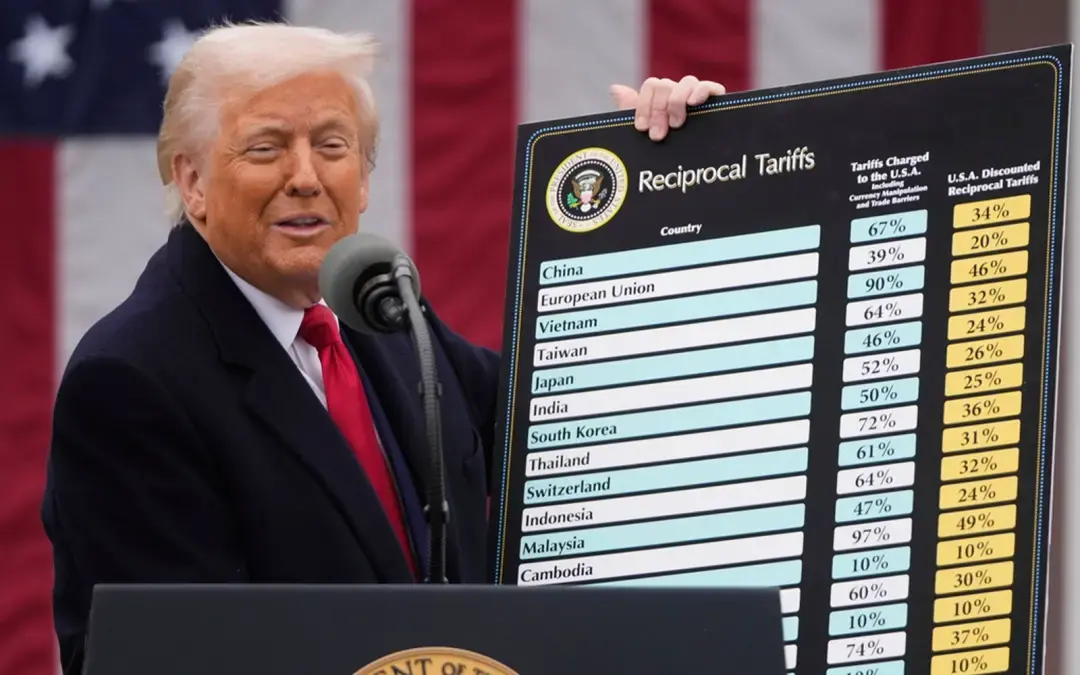

Impact of Trump's Reciprocal Tariffs on US-Japan Auto Trade

The implementation of the 25% tariff on imported vehicles by the Trump administration on April 3, 2025, has dramatically altered the US-Japan automotive trade relationship. This policy shift, justified as creating "reciprocal" trade conditions, has significant implications despite Japan's existing zero-tariff policy.

Economic Consequences for Japan

The new US tariffs pose substantial challenges for Japanese automakers:

-

Potential loss of $17 billion in export opportunities to the US market

-

Pressure on major manufacturers like Toyota and Honda that rely heavily on US sales

-

Declining business sentiment among Japanese manufacturers

Japanese Prime Minister Shigeru Ishiba has been actively seeking exemptions from these tariffs, even expressing willingness to travel to Washington for direct negotiations with President Trump. The Japanese government is considering various support measures for affected companies, recognizing the potential impact on the broader economy.

Negotiation Points and Potential Outcomes

As trade tensions escalate, several key negotiation points have emerged:

-

Market Access Reality: While Japan technically maintains zero tariffs, the US argues that non-tariff barriers effectively limit market access

-

Reciprocity Definition: Debate over whether reciprocity should be measured by tariff rates alone or overall market access

-

Regional Alliances: Japan's coordination with South Korea and China to respond collectively to US tariffs

-

Production Shifts: Potential acceleration of Japanese manufacturing investment in US facilities to avoid tariffs

Opportunities for US Exporters in the Japanese Market

Despite these challenges, the current trade environment presents several opportunities for US vehicle exporters targeting the Japanese market:

Niche Market Potential

-

Classic and Vintage American Cars: Growing collector interest in American classics that benefit from Japan's zero-tariff policy

-

Luxury Performance Vehicles: High-end American sports cars and premium SUVs with unique appeal

-

Electric Vehicles: Increasing Japanese interest in American EV technology, particularly Tesla models

Strategic Approaches for Success

-

Focusing on vehicle categories that complement rather than compete with domestic offerings

-

Adapting designs for Japanese market requirements

-

Developing stronger dealer networks and after-sales support

-

Leveraging e-commerce and digital marketing to reach Japanese consumers directly

Navigating International Vehicle Shipping in the Current Environment

For businesses and individuals looking to export vehicles from the US to Japan in 2025, understanding the logistics and compliance requirements is essential to success.

Documentation and Compliance

-

Japanese vehicle certification requirements

-

Emissions and safety standard compliance

-

Import registration process

-

Tax considerations beyond tariffs (consumption tax, etc.)

Shipping Options and Considerations

-

Container vs. RoRo shipping methods

-

Port selection and transit times

-

Insurance and protection during transit

-

Customs clearance procedures

Our international car shipping services provide comprehensive support for navigating these complexities, ensuring smooth vehicle transport from US ports to Japan with full compliance and minimal delays.

Future Outlook: Balancing Reciprocity and Market Reality

As trade negotiations continue, several potential scenarios could emerge:

-

Negotiated Exemptions: Japan may secure partial exemptions from US tariffs in exchange for addressing specific non-tariff barriers

-

Production Shifts: Accelerated relocation of Japanese manufacturing to US facilities

-

Diversification Strategy: Japanese automakers may increase focus on other markets like China, Germany, Philippines, and Thailand to offset US losses

-

Targeted Reciprocity: Development of sector-specific agreements rather than blanket tariff policies

Navigating the Evolving Trade Landscape

The contrast between Japan's zero-tariff policy and the new US 25% tariff highlights the complexity of international trade relationships beyond simple duty rates. For those involved in vehicle exports to Japan, understanding both the technical aspects of tariffs and the broader market dynamics is essential.

While trade tensions create uncertainty, they also present opportunities for strategic exporters who can navigate the regulatory environment and meet Japanese market needs. With proper planning and logistics support, US exporters can leverage Japan's zero-tariff policy to develop profitable export channels despite the challenging trade environment.

For businesses looking to ship vehicles between the US and Japan in this complex trade environment, working with experienced international shipping partners is more important than ever. Our team specializes in navigating these evolving regulations, ensuring your vehicles arrive safely and efficiently while minimizing customs complications.

You May Also Like

These Related Stories

90-Day Tariff Pause Explained: Impact on Global Car Shipping in 2025

Opportunities For Growing Trade With Car Tariff Exemptions

-093789-edited.png?width=220&height=79&name=wcs_final_logo_(1)-093789-edited.png)