DMV Registration fees when exporting your car overseas

Have you purchased or sold a car from the United States for export? The US Department of Motor Vehicles, better known as the DMV, will likely chase you for vehicle registration fees. However, if the vehicle was sold and exported overseas, you do not have to pay them. All you have to do is complete a statement of facts, and attach a proof of export.

- Statement of fact form to complete, print and mail to the DMV: Here

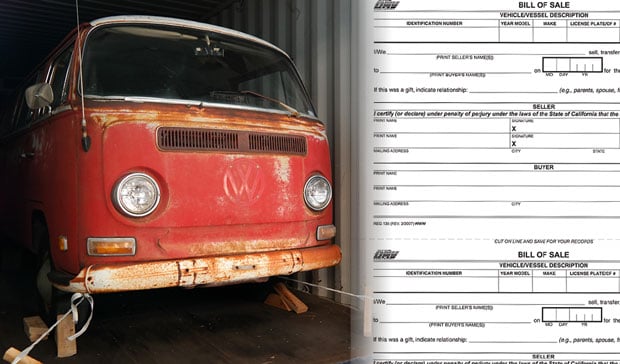

- You should also ask your shipping company to provide a proof of export in form of a Bill of Lading (BOL)

After submitting this documentation, the DMV will stop chasing you for registration fees on a vehicle you no longer own.

The specific requirements for exporting a car vary from state to state. In some states, you will need to fill out a form and submit it to the DMV. In other states, you may be able to simply notify the DMV verbally.

Before exporting a car from your state, it is crucial to check with your local DMV to find out what the specific requirements are. Each state has its own set of regulations and procedures when it comes to exporting vehicles, and failing to comply with them can result in legal and financial consequences. By reaching out to the DMV, you can get a clear understanding of what documents you need to submit and what fees you need to pay, if any. This will help you avoid any surprises down the road and ensure a smooth export process for your car. So, make sure you do your due diligence and reach out to your local DMV before shipping your car overseas.

Exporting a car can be a complex process, but it is important to follow the necessary steps to ensure that you are in compliance with the law. By following the tips above, you can help to make the process go smoothly.

You May Also Like

These Related Stories

Shipping a car overseas? Bill of sale is a MUST!

DMV Certificate of Exportation: Is It Required?

-093789-edited.png?width=220&height=79&name=wcs_final_logo_(1)-093789-edited.png)