California car export: How to avoid DMV registration fees

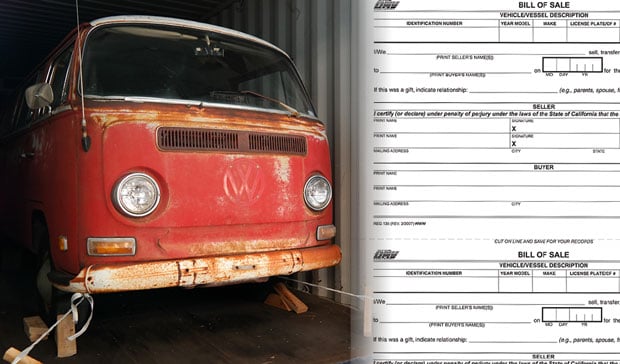

You've purchased your dream car from California and now you want to get it home overseas. You've gathered all the documents and organized shipping, what else is required you may ask. Well, if you've purchased a vehicle that is registered in the state of California, you're also required to let the Department of Motor Vehicles (DMV) know that the vehicle will be exported, or you and the seller both face fees.

Why does the DMV want to charge fees on a vehicle that's out of the country? They don't necessarily want to charge anything, but they have no way of knowing the vehicle was exported unless you tell them so.

There are two ways to notify the DMV that the car has left the country. The form required is the Certificate of Exportation REG 32, which has to be brought into their office, along with the original title.

Visiting a DMV office is the last thing anyone wants to do, so there's another way to save everyone their valuable time.

The second option is to simply complete a Statement of Fact Reg 256. This can be done even after the vehicle has already been exported, and you do not have to do it in person. You simply enter your vehicle information up top, and then move down to Section G and provide a statement saying the vehicle has been exported. You can write something like this; "I have exported my car out of the country. Please remove it from your database and no further registration is required. Proof of export is attached via a copy of the bill of lading".

Once completed, print it, attach a copy of your bill of lading (provided during export) and mail it to a California DMV office. This is all that is required to remove the car from the California DMV system, and avoid unnecessary fees.

If you're a seller who is stuck with registration fees on an exported car, you can do the same thing.

You May Also Like

These Related Stories

DMV Registration fees when exporting your car overseas

DMV Certificate of Exportation: Is It Required?

-093789-edited.png?width=220&height=79&name=wcs_final_logo_(1)-093789-edited.png)